According to PBS Brokers, while Wall Street weathered its ups and downs throughout 2023, small and mid-sized businesses recorded a good year for financial performance, business values and business sale transactions.

Speakers at a local economic conference seem to agree, based on an article from the Austin Business Journal. However, just because the Austin metro area is viewed as an economic safe harbor doesn’t necessarily mean businesses aren’t struggling.

The Austin metro area had an unadjusted unemployment rate of 2.7% in December, down about 20 basis points from a year prior. According to the Texas Workforce Commission, this was the third-lowest rate in the state and lower than the 3.3% national average.

Amid this employment and economic turmoil, business owners may consider selling their businesses for various reasons, from a shrinking industry to debt piling up. So, you may ask, when should I consider selling my business?

How do you know when it’s time to sell your business?

Challenges Don’t Excite You

When you first started your business, everything was a challenge, and you reveled in it. The passion and drive were fresh, and the business of business hadn’t caught up with you just yet.

These days, you’re dealing with more than you ever planned, and it’s taking a severe toll on more than just your business. If you don’t have the drive to tackle new challenges, or if they aren’t the kind of challenges that drive you, it may be time to think about what appeals to you and consider selling.

When you find yourself settling for the status quo, not looking to push forward, and just not enjoying solving problems for your business anymore, then you are likely to forgo growth opportunities, with both you and your employees losing out. The fair thing to do when you’ve lost passion for your business is to look for a solution, and that may be to sell your business.

See Our Blog: Tips for Negotiating Business Contracts

You’re In Over Your Head

Anxiety and generally feeling overwhelmed are natural when owning a business. However, when the scale begins to tip past burnout, you may begin to consider leaving the business entirely, whether by selling to a partner or tackling an entirely new venture.

Taking on running a business isn’t easy in the best of circumstances. Add family, employees, and economic and political uncertainty; it can feel like you’re out of your depth.

Before you consider the sale of your business, it could be a good idea to take time to consider what steps you’ve taken to try to manage your burnout like:

- Have you carefully defined your business goals?

- Are you managing your time well and delegating when you need to?

- Have you hired the right team? Have you hired at all?

- Do you understand your financial situation and what it means to keep your business not only running, but actively growing?

- Is there anything that might help you manage better? Are you really in a desperate position or do you need to talk to someone who can help you answer these questions?

If you act on the items above and still feel like you’re not in a place to continue running your business, it may be time to think seriously about selling.

You’re in a Shrinking Industry

It’s always tricky to future-proof a business. The first step should be reviewing your strategic positioning and exploring various ways to help your business grow.

Amazon is a great example of strategic modernization. Back in 1995, they were known as the “Earth’s Biggest Bookstore.” They sold new, physical books online. Slowly, the brand began to sell goods from other vendors, with eBay as their primary competitor.

Now, they’ve successfully modernized their business to take advantage of their size and position in the e-commerce market and, as you know, sell almost anything.

If you can’t find a way to adapt and modernize, or you simply don’t have the interest or energy to do so, it may be time to consider moving on. However, this isn’t a choice you should consider lightly. Take the time to analyze everything you’ve done over the last few years, ask your team for innovative solutions, and see if anyone at the company is interested in taking on the challenge as you step back.

You’re Aging Out of the Business

When you’ve gotten to the age of thinking increasingly about retirement, it’s time to consider a succession plan for your business, particularly if you have a partner or senior employee you trust. Is there a family member that works with you? What happens if your children don’t want to take over your business? Do you have a partner who might be interested in purchasing the business from you?

Aging out of the business is something to look forward to. You can choose to retire or explore other options for a career you’ve always wanted to try. Whatever you decide, the next step of your life should be handled with care. Meeting with a business consultant or attorney and exploring all your options can help the transition go smoothly.

See Our Blog: What to Expect When Selling Your Business

When You Should Stick It Out and Not Sell Your Business

Business sales and acquisitions of small businesses with weaker financial performance were slow in 2023 and will likely continue through 2024.

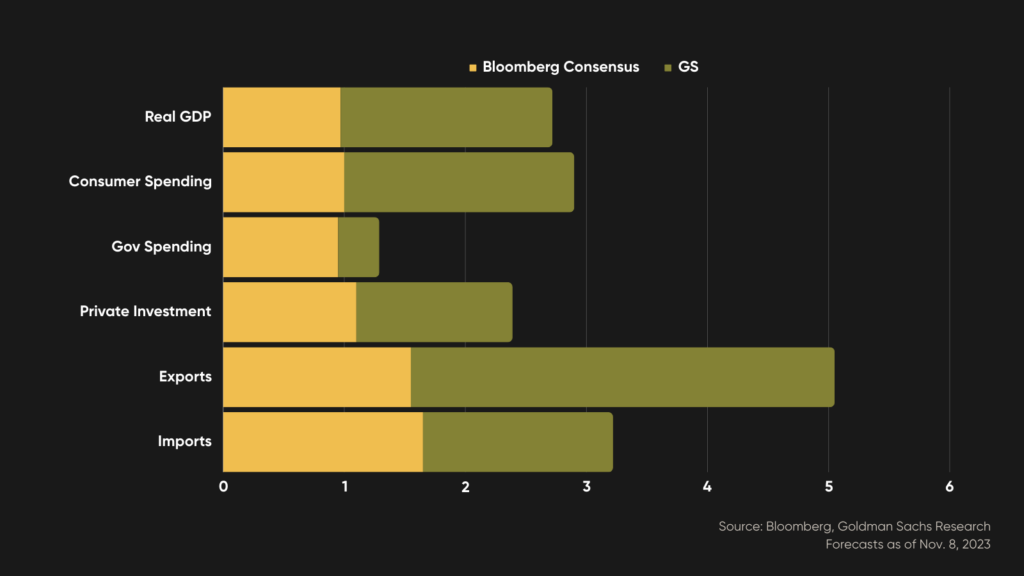

Goldman Sachs Research’s US GDP forecast is well above consensus. With GDP growth near the economy’s potential growth rate, conditions for the labor market are forecast to be roughly stable in 2024.

In the immortal words of The Clash, “should I stay, or should I go?” moments are critical junctures for business owners. If you’re seriously considering the “go” part, consider contacting a business law firm like Richards Rodriguez & Skeith for help with your decision. We’d love to hear from you.

Do you have questions regarding the sale of your business? Contact our team to discuss your options.